Verso l’Alto

Many of you may have noticed that I replaced my email signature sign off. I changed from the classic, “Sincerely” to a much more obscure, “Verso l’Alto”. Many people have inquired on this change, and I thought it appropriate to spend some time to discuss this in the context of another topic I’d like to write to you about. This month’s education piece is on an aspect of financial planning that is little talked about, but makes a huge impact. Let’s dig in:

Verso l’Alto is an Italian phrase which translates into English as, “To the Heights”. This phrase was popularized by Pier Giorgio who was a faithful Catholic and mountain climber. He is being evaluated for canonization (the process of declaring someone a saint) for his love of God and of the poor. Pier wrote this short Italian phrase on a photograph of him climbing a mountain. People have gathered much insight from this phrase as it seems to have two senses in which it was meant. Pier certainly meant literally that he was going “to the heights”, as he was climbing up the side of a mountain to its pinnacle. However because Pier was a man of faith, people have noted that this “to the heights” can also be interpreted as the mans soul ascending to God. As you can see, as a man who wants to be faithful and successful, this phrase has much meaning. It is also interesting to note, that Harrison Butker of the Kansas City Chiefs, who recently won his third Super Bowl, adopted “to the heights” as his personal motto, adding that phrase to social media posts.

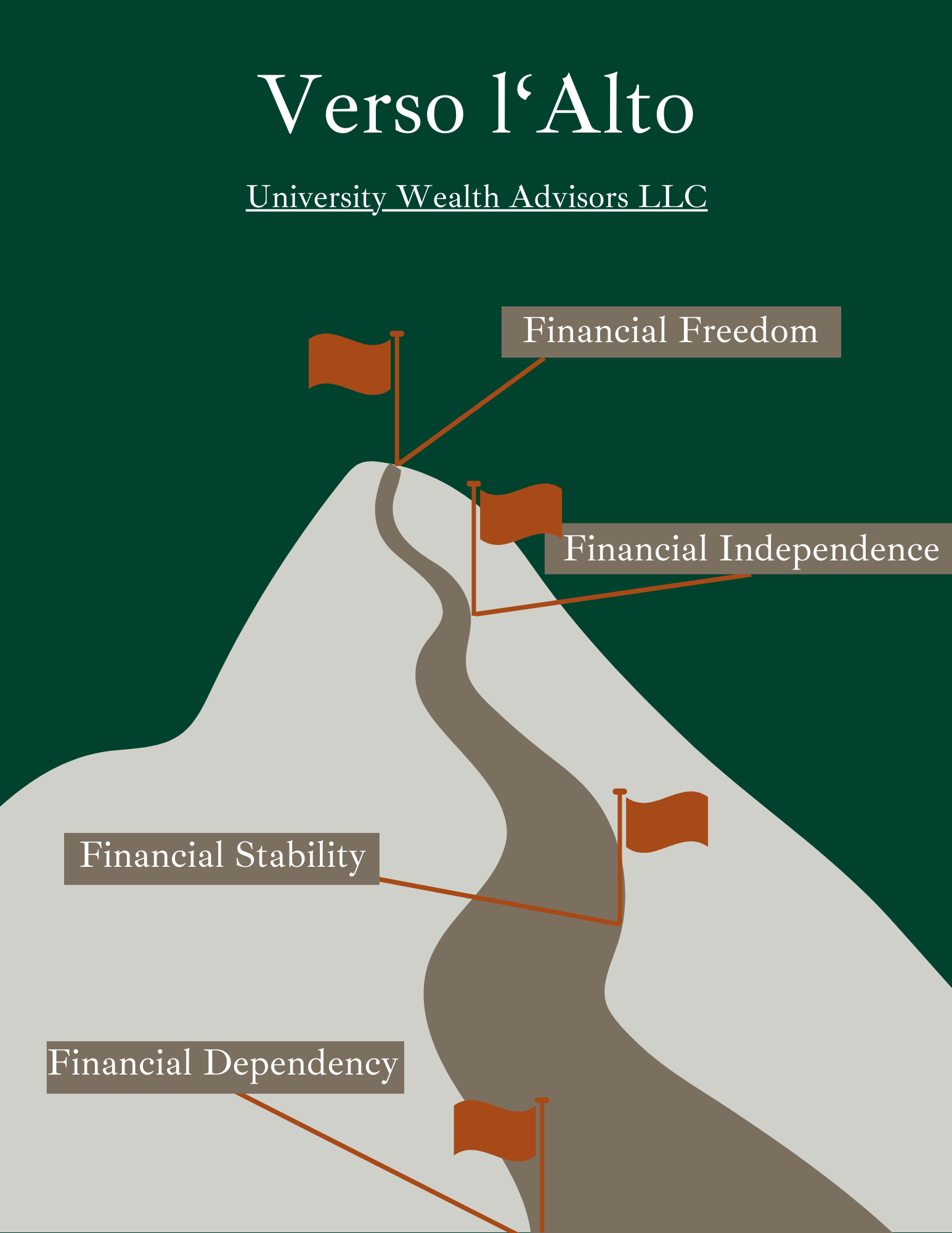

So what does Verso l’Alto have to do with financial planning and wealth building? If you have not made the connection between the illustration on the front of this document and this phrase yet, here is an explicit connection: wealth building starts off small, then gains momentum and ultimately is aimed at a peak. Just like a mountain, you can climb to the peak of financial success. I recently read a report from a large consulting firm that said that the highest level of service that a wealth management firm can offer its clients is not better investment returns, tax strategies, or estate planning, but rather “self- transcendence”. This was interesting as no one engages a financial advisor and asks them to help them with attaining self transcendence. However, if you think about the wealth building journey in the context of Maslow's Hierarchy of needs, this actually makes sense. Once we have our basic needs met, have some money saved for the future, and are comfortable, the mind goes out to accomplishing something bigger and beyond itself. Maslow calls this “self -actualization”. When I think of self-actualization in this context, it brings to mind the great achievements clients of mine have made in their fields. Their finances allow them to live their daily lives, but are often ordered toward accomplishments in their fields of study, supporting their families and future generations, and accomplishing something beyond their daily needs.

In the financial planning context, what starts as a relationship with an advisor to accomplish functional tasks like portfolio management, estate planning, and tax planning, often slowly moves to this self-transcending relationship. So whether you want to leave a legacy in your field of study, in your family, or in a local community, by utilizing University Wealth Advisors as your wealth management partner, you can go To The Heights!